Mastering OCO Orders in Cryptocurrency Trading: A Guide to Strategic Risk Management

5 February, 2024

In the fast-paced and often unpredictable world of cryptocurrency trading, managing risks and optimizing profits are paramount. One effective tool in the arsenal of savvy crypto traders is the "Order Cancels Order" (OCO) mechanism. This detailed guide will explore OCO in the context of cryptocurrency trading, including its functionalities, ideal use cases, and how platforms like HyperTrader enhance trading strategies with this feature.

What is OCO?

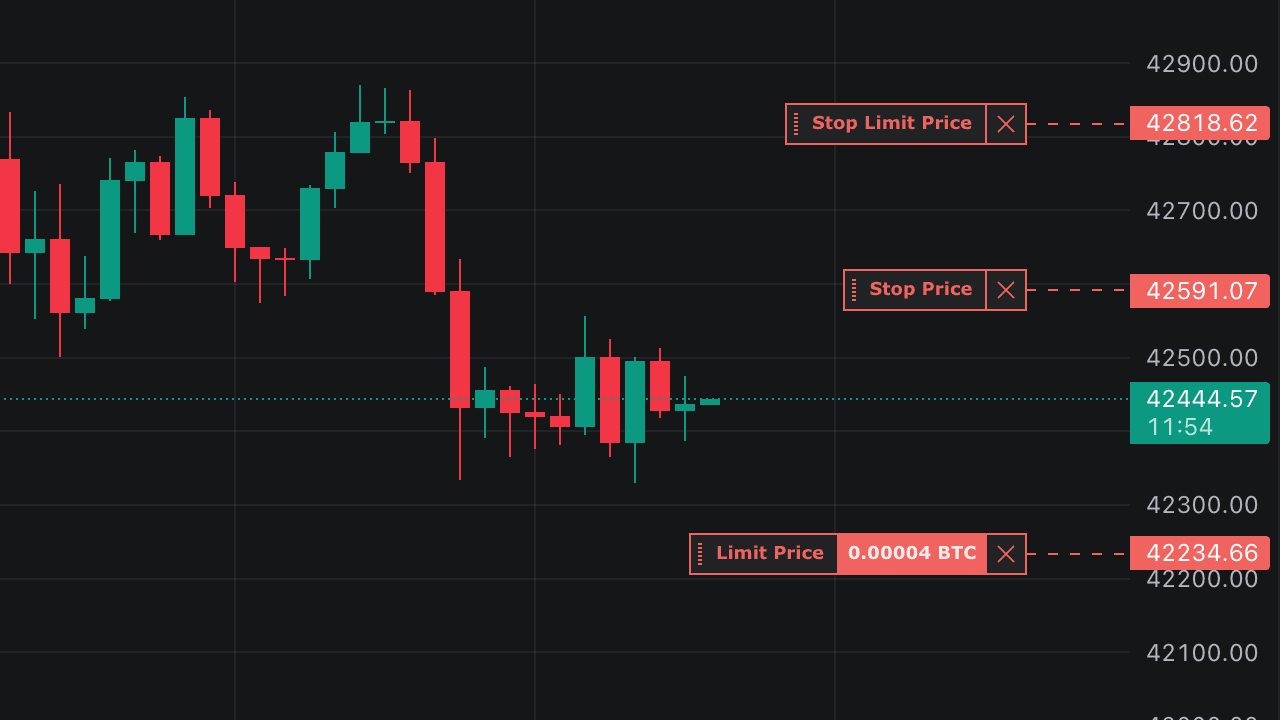

OCO, short for "Order Cancels Order," is a conditional order type that links two market orders. In this setup, the execution of one order automatically leads to the cancellation of the other. This mechanism is particularly beneficial in the volatile cryptocurrency market, as it allows traders to set predefined entry and exit points for their trades.

Example in Cryptocurrency Trading:

Consider you have bought Bitcoin at $20,000. To secure profits and limit losses, you set an OCO order with a sell limit order at $25,000 and a sell stop order at $18,000. If Bitcoin hits $25,000, your sell limit order gets executed, securing your profit, and the stop order at $18,000 is canceled. Conversely, if Bitcoin drops to $18,000, your stop order triggers to minimize losses, and the limit order at $25,000 is withdrawn.

Why Use OCO in Crypto Trading?

OCO orders are invaluable in the crypto market for several reasons:

- Volatility Management: Cryptocurrencies are notoriously volatile. OCO orders help manage sudden price swings.

- Emotional Discipline: They enforce a disciplined trading strategy, reducing impulsive decisions.

- Time Efficiency: OCO orders are a boon for those who cannot constantly monitor the erratic crypto market.

Who Should Use OCO in Crypto Trading?

- Day Traders and Swing Traders: These individuals can benefit from OCO orders due to the short-term nature of their trading strategies.

- Risk-Averse Crypto Investors: Investors who prioritize risk management in their trading decisions.

- Traders with Limited Time: Those who cannot monitor the market around the clock.

Not All Platforms Support OCO

It's crucial to note that not all crypto exchanges or brokers offer OCO orders. However, platforms like HyperTrader provide this functionality for certain exchanges, enhancing the trading experience by incorporating advanced order types.

Pros and Cons of OCO Orders in Crypto Trading

Pros:

- Strategic Trading: Set precise entry and exit points based on your trading strategy.

- Risk Control: Limit potential losses while also setting targets for profit-taking.

- Market Independence: Less need to continuously watch the market.

Cons:

- Slippage in Fast Markets: In highly volatile markets, orders may not fill at the expected price.

- Complexity for Beginners: Novice traders may find the concept challenging to grasp initially.

- Missed Opportunities: Over-reliance on OCO orders might lead to missed opportunities if market conditions change rapidly.

Advanced Tips

- Strategic Order Placement: Carefully analyze support and resistance levels to set your OCO orders effectively.

- Regular Review: Continuously review and adjust your OCO orders in response to market changes.

- Complement with Other Tools: Combine OCO orders with other trading tools and indicators for a more robust strategy.

Try OCO on HyperTrader

HyperTrader is an advanced trading platform that supports OCO orders on certain exchanges. This feature is particularly beneficial for crypto traders looking to enhance their trading strategies with sophisticated order types. Experience the strategic advantages of OCO orders in cryptocurrency trading with HyperTrader. By incorporating OCO orders into your trading approach, you can manage risks more effectively and capitalize on market opportunities with greater precision.

OCO orders, when used effectively, can significantly enhance your cryptocurrency trading strategy, providing a balanced approach to risk management and profit maximization. With platforms like HyperTrader offering this functionality, traders are better equipped to navigate the volatile crypto market. As always, successful trading combines the right tools with sound strategy and continuous learning. Happy and strategic trading!

Sign up for HyperTrader today and elevate your crypto trading experience.

Try Today For Free

Transform your trading experience with HyperTrader. Say goodbye to slow terminals, multiple windows, excessive clicks, and delayed data. Sign up and start using our platform in under 10 minutes to unlock your full potential.